General Security

USALLIANCE takes the security of our members, their information, and their funds very seriously. We constantly review our security measures and compare to the highest industry standards to ensure that we are always doing our best to protect our members.

We also help our members by keeping them informed on the types of scams they may encounter and things they can do to protect themselves. Below, are descriptions of common types of financial fraud and scams, measures members can take to protect themselves, related articles, and additional fraud resources.

Best practices for security:

- NEVER share your account details with a third party, including account number, PIN, member number, password, and username.

- NEVER share an access code you were sent as a form of multifactor authentication.

- USALLIANCE will NEVER initiate contact with you and ask for account information. If you are contacted and asked for such information, do not respond and immediately contact USALLIANCE directly.

- If you ever feel as though you are being pressured, or you feel at all suspicious about a call, text, email, or any other communication you get from someone claiming to be USALLIANCE stop responding or hang up immediately and get in contact with USALLIANCE directly.

Common Types of Fraud and Scams

-

Imposter Scams

In these cases, the scammer will pretend to be a trusted source, such as a family member, a friend, a representative from a government agency, or a representative from your financial institution. If they can gain your trust, the imposter will try to trick you into divulging your personal information or transferring them money.

Financial institutions and government agencies, like the IRS, will NOT contact you and ask you for your personal information. If you are at all unsure, stop communicating and immediately get in direct contact with the alleged agency or institution.

-

Internet Shopping Scams

Those who shop online are at risk for a number of scams, including paying for products that never arrive, losing financial information to scammers, and being tricked into using phony websites. Scammers have the ability to create convincing, fake versions of popular websites and apps. Victims will enter their payment information into the fake site without knowing, and hand it over to the scammers. Counterfeit apps can contain malware that infects your device.

Be vigilant when shopping online – be on the lookout for false websites, shop with a credit card that offers protection for fraudulent purchases, and keep a close eye on your statements for any suspicious activity.

-

Prizes, Sweepstakes, and Lotteries

In this scam, the fraudster contacts you claiming you won some sort of prize, lottery, or sweepstakes, but then asks you for money to cover some sort of fee up front. The scammer might even pretend to be from a government agency.

Government agencies do not ask for your financial information or for you to send them money to collect a prize. If you did not enter such a contest or are unsure about the communication you received, stop communicating immediately and call the organization to verify the communication. Especially do not send them money or divulge any information. Above all, remember, if it seems to good to be true – it probably is.

-

Romance Scams

Romance scams involve fraudsters taking on a fake online identity and beginning a fake relationship with their victim. Through the building of this “relationship”, they gain your trust and manipulate you into thinking that this is a legitimate romance. Any plans to meet in person are avoided or cancelled since it would ruin the scam, but the scammer will ask for money or try to trick you into giving away sensitive information. Always be wary of someone you have never met in person, and avoid giving them personal information or money.

-

Business and Job Opportunity Scams

Scammers advertise job openings or a business opportunity that (once again) sounds too good to be true. If it involves high pay for minimal work or an easy way to start a business with a “fool proof” system, then you should be suspicious. Do not provide personal information or money to these entities, and always conduct your own research before engaging with a company.

-

Investment Fraud

There are several types of investment fraud. You may have heard of some of the more popular ones like Ponzi schemes and pyramid scams. Though they are called by a lot of different names, most investment scams share common traits, like guaranteeing high returns with no risk and high-pressure sales tactics.

In these scams, the person you’re in contact with will often be secretive about specifics and details, especially avoiding putting them in writing. Don’t rush into an investment without doing your own research or consulting an advisor, especially if they are trying to pressure you to act now. Again, a good rule of thumb is that if the investment sounds too good to be true, then it probably is.

-

Disaster Fraud

Disaster fraud generally involves scammers trying to take advantage of a bad situation by impersonating government employees and setting up bogus charities. In these scams, the criminals will exploit your good nature and take “donations” from you meant to go to assisting in a disaster. In other examples, they may even try to defraud victims of the disaster by requesting money when victims try to apply for relief. Be diligent in making sure that you are dealing with a legitimate government agency or charity in any disaster situation.

-

Fake Check Scams

Fake check scams take many forms, but generally involve two main components:

- The scammers send cashier’s checks or money orders to you

- They ask you to send some money back to them in the form of gift cards, money orders, or cryptocurrency.

There is a reason scammers choose these types of payments. Cashier’s checks can take weeks to validate, so by the time you’ve realized that you were scammed, the fraudster is long gone and you’re left to foot the bill. If you send gift cards, money orders, or cryptocurrency, your funds are not protected.

-

Check Washing Scams

Check washing scams involve changing the details on checks and fraudulently depositing them. The United States Postal Inspection Service website has additional details on check washing scams.

Ways to Protect Yourself

As you can see, there are quite a lot of different ways that scammers have come up with to separate you from your hard-earned money. However, there are a lot of things that members can do themselves to improve their security and help protect against fraud and identity theft. Below is a list of measures that members can take today to guard themselves against criminals:

-

Make sure your contact information up to date

Having your contact information up to date ensures that USALLIANCE is able to get in contact with the real you when necessary. If your contact information is not up to date, it is more difficult to notify you of things like suspicious activity, and can cause challenges in validating you are who you say you are. Members can update their contact information in digital banking at any time.

-

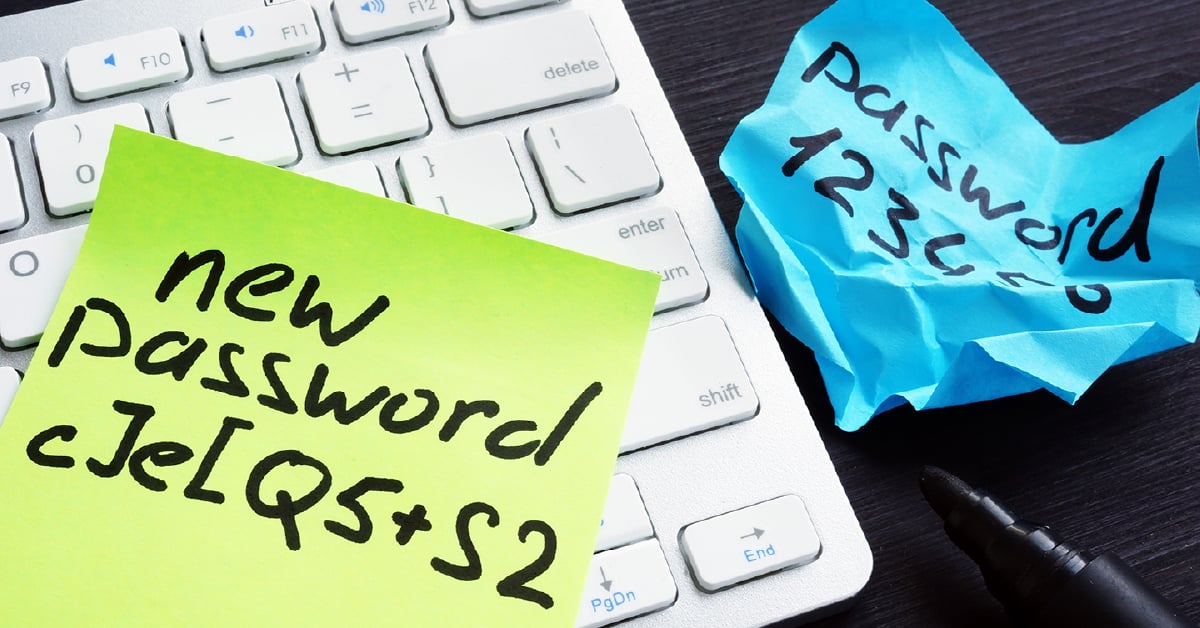

Create the strongest possible passwords

There are billions of passwords exposed by hackers every year. Some of the main culprits are simple passwords, common passwords, and reused passwords. According to Hive Systems, an 8-character password containing numbers, upper and lowercase letters, and symbols can be cracked in only 5 minutes, but with 12 characters it would take 226 years.

-

Set up alerts in digital banking

Setting up alerts can give you instant notification of suspicious activity, allowing you to act quickly to minimize the impact of any fraudulent activity.

-

Keep your devices updated

They might seem irritating when they’re interrupting you, but you should take the system update notifications on your device seriously. Many of these updates are patching vulnerabilities in the system that hackers and scammers can exploit. Turning on automatic updates can keep more protect with minimal effort on your part.

-

Enable fingerprint or facial recognition on your device

Biometrics like fingerprint or facial recognition can give you an added layer of protection and increase your overall safety.

-

Recognize red flags that signal a scam

The easiest way to avoid negative impacts of a scam is to nip it in the bud. If you provide information or money to a scammer, there is often very little that can be done. It’s best to never reach that stage and learn to spot warning signs early.